Whether you choose to renew early or not, it’s wise to use this four-month period to weigh your options and decide how you want to proceed at the end of your term.Īn early mortgage renewal can save you money if you expect mortgage rates to rise in the short-term. This only applies if you stick with the same lender switching providers before the end of your term can result in paying a penalty. Most lenders allow you to renew your mortgage early without any penalties, up to 120 days (or four months) before the end of your term. No matter how you decide to proceed, give yourself plenty of time to research your mortgage options-don’t wait until your renewal notice arrives to get started. For example, during the first half of 2022, both variable mortgage rates and fixed mortgage rates rose due to changes in the economy. Fluctuations like these can impact the rate you can expect to get.

It’s important to shop around and compare the rates at other lenders, too. It’s common for mortgage providers to offer discounts to existing customers at renewal time, but those discounts may not be as good as what you can get elsewhere.

However, it’s not always the best financial decision. Renewing with your current lender is fast and convenient. Things to consider when renewing your mortgage Note that, in some cases, your mortgage contract may renew automatically if you don’t renegotiate or change providers before your current term ends. When providing you with the renewal notice, your lender may also send you a new mortgage contract to sign. If your lender chooses not to renew your mortgage (because you have not been meeting your obligations, for example), it must also notify you 21 days in advance. The statement will contain information on the mortgage contract to be renewed, including the mortgage balance, interest rate, payment frequency and term. If your lender is a federally regulated institution, like a bank, you should receive a renewal notice at least 21 days before your current mortgage term expires. You can renew with your current lender for another term or choose a new lender whose conditions better suit your needs.

#Simple refinance mortgage calculator full

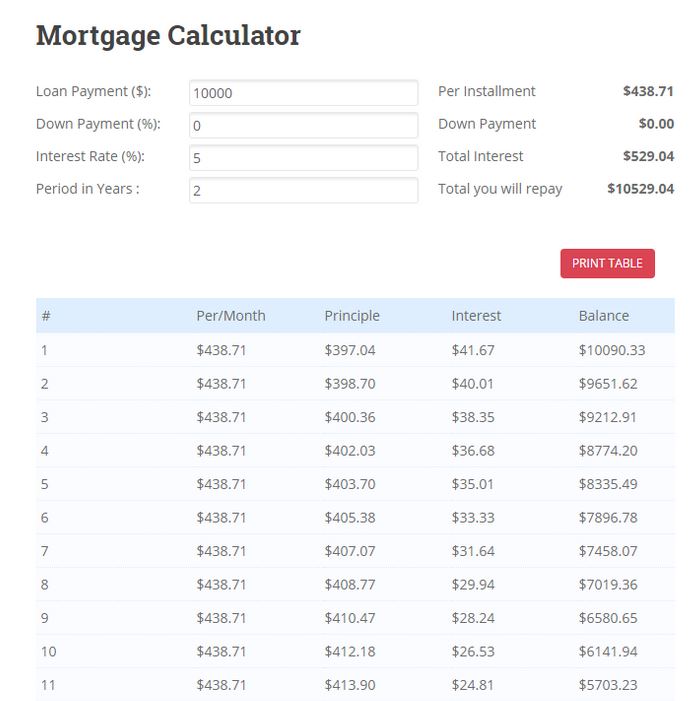

If you haven’t paid off your mortgage by the end of your mortgage term, you’ll need to repay the balance in full or renew your mortgage contract. Using a renewal calculator is one of the easiest ways to determine if your current mortgage is working for you or if it’s time to find one that better suits your needs. (The tool also takes into account the size of your original down payment.) The calculator finds the best rates currently offered by a variety of lenders across Canada and shows you how much your regular mortgage payment would be. You can enter four sets of variables at once.

#Simple refinance mortgage calculator plus

The mortgage renewal calculator allows you to compare different mortgage offers, based on a specified mortgage amount and location plus the following variables: amortization period, interest rate and payment frequency. I'm buying a home I'm renewing/refinancing You will be leaving MoneySense.

0 kommentar(er)

0 kommentar(er)